Nonprofit Resources

The Importance of Accurate Net Asset Classification in Church Accounting

Is your church classifying net assets correctly? Churches that don’t opt for an independent audit or review often use the terms “designated,” “restricted,” “board-restricted,” and “board-designated” interchangeably when classifying net assets (funds). As a result, these churches can get caught in a rhythm of recording every donation under a single “restricted fund” type, losing critical visibility into which funds the church has sole discretion over and which must legally be held in restriction until expensed for the express purpose indicated by the donor.

In addition, without clear distinctions, net assets may be held in restriction unnecessarily instead of being used where they are most needed. Conversely, net assets could be expensed inappropriately for general purposes, putting the church at risk of not having funds available to fulfill its legal responsibility in good faith to donors who gave funds for specific purposes or projects.

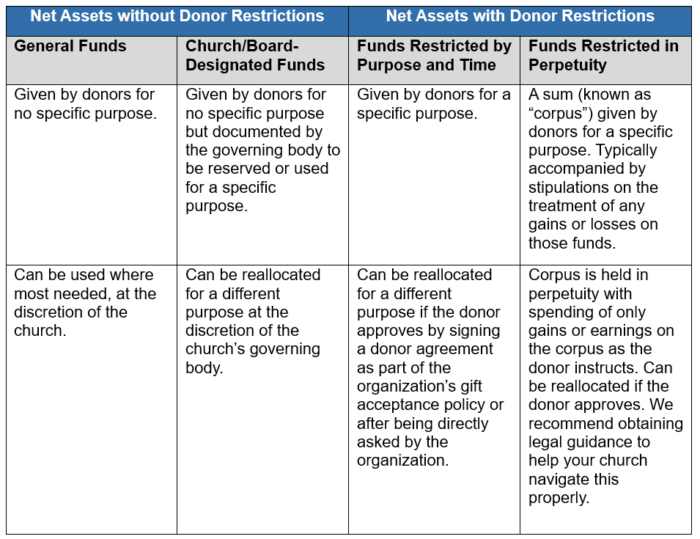

The table below highlights how net assets should be categorized and the differences between each category.

Ultimately, the proper net asset category comes down to messaging. Did the donor give their gift for a specific purpose, project, or program, as indicated by a note accompanying the donation, or because it was given during a particular offering time or in response to a specific appeal? Those funds would be classified as donor restricted. Did the governing body vote to designate or reserve a certain amount from the general fund toward a specific initiative? Those funds would be classified as designated.

A key point is that it matters who makes the statement that a gift is given for a specific purpose, whether they use the term “restricted,” “designated,” or another term. If the designation or restriction as to purpose is made internally, such as by the board or management, then this is not a “restricted” gift within the meaning of generally accepted accounting principles (GAAP), nor is such a designation or restriction legally recognized if a judgment were issued against the church in favor of a creditor. If the designation or restriction as to purpose is made by a donor, then the funds must be separately accounted for and only used for the purpose specified by the donor.

Gift Acceptance Policies

An effective gift acceptance policy can help your church manage donated funds appropriately. A gift acceptance policy should broadly address the following:

- The types of gifts your church will accept

- Handling procedures for different types of gifts

- The stipulations for the expiration of donor restrictions

For example, a church’s gift acceptance policy could include a statement that if the total giving for a specific program or purpose exceeds the need for that program, the surplus funds can be allocated to a different purpose. This could be one of the “terms and conditions” donors accept when submitting a gift online or by mail with a reply card, or it could be delivered more straightforwardly for donor approval.

A gift acceptance policy can help provide guidance to your donors and prospective donors as well as protect your church, your leaders, and your staff from feeling pressure to accept gifts with restrictions that the church is not prepared to manage.

Gaining Financial Clarity

Correct net asset classification is essential for maintaining financial integrity and transparency within churches. By taking steps to categorize your net assets accurately, your church can ensure that funds are used appropriately and in alignment with donor intentions. You will also gain vital insight into the funds available for unrestricted use, which can help your church make informed financial decisions and uphold your commitment to good stewardship.

Please contact us with any questions or if we can assist your church.

Additional Resources:

Elements of a Well-Drafted Gift Acceptance Policy

Should Your Organization Accept that Gift?

Authors: Courtney B. Gregory, Partner and Rachel Malone, Supervisor – Consulting