Nonprofit Resources

Quick, Easy Wins to Help Your Institution Prevent Title IV Compliance Findings

This is the first year that higher education institutions’ annual compliance audits will include testing on data acquired with the new Free Application for Federal Student Aid (FAFSA) form. Performing a compliance risk assessment and implementing proactive measures could result in the early identification of errors and help prevent future compliance findings.

We’ve put together steps to help you identify errors before your annual compliance audit. These actions do not have to be time-consuming or expensive, and they can be done by someone in an existing financial aid role. In other words, these steps can be quick, easy “wins” for your institution.

Six Quick, Easy Wins

Here are six proactive measures for your institution to consider:

1. Create a process to ensure Pell Grant calculations are accurate under the new enrollment intensity requirements.

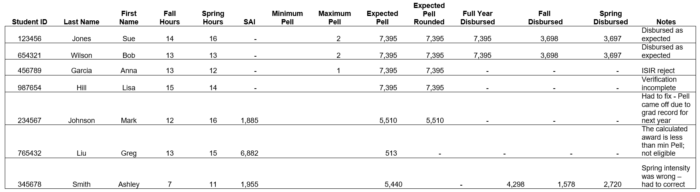

Your institution’s IT team may be able to write a report to pull all the data at once. If not, you can follow these steps to generate the information shown in the example table below:

- Run a file of all currently enrolled students with fall hours.

- Run a file of all currently enrolled students with spring hours.

- Merge the two lists. Add any non-matching rows to the bottom so you catch students who are only enrolled in one term.

- Run a file of all Student Aid Indices (SAIs) and merge it into your report. Remove any students without a FAFSA, graduate students, or students in a program that is ineligible for the Pell Grant.

- Run a file of all minimum and maximum Pell-eligible students. Although their SAI may not reflect that they should receive the Pell Grant, you need to identify them.

- Once you have listed minimum and maximum Pell-eligible students, you can remove any students with an SAI over $7,395, as they are not eligible for the Pell Grant.

- Create an “expected Pell” column and enter a formula of $7,395 minus SAI. Copy this formula all the way down. This is what you would expect to disburse to their account if they are enrolled full-time for both terms. (Note: this won’t be accurate for your maximum and minimum students, but you can calculate their formula separately.)

- Update any negative SAIs to $0 for the expected Pell amount to be accurate.

- Round to the nearest $5.

- Clean up the expected Pell column for various groups (for example, if the SAI is over $7,395 but they have a minimum Pell indicator, the expected Pell should be $740).

- Reorganize your spreadsheet into groups with similar enrollment intensity. You can sort the data as follows and then keep resorting and grouping enrollment intensities together so that it is easier to check for accuracy:

- All students who were full-time for both terms, since they should have full expected Pell disbursed.

- Students who were full-time for one semester with 0 hours for another term.

- Students who were full-time for one semester with 11 hours for another term.

- Students who were full-time for one semester with 10 hours for another term, etc.

- Once you have finished sorting, run a report of Pell disbursed within your student information system and merge it into the sorted spreadsheet to show what has actually been disbursed to each student’s account.

- Now look for any amounts disbursed that don’t match the expected amount and see if there is a logical reason for the discrepancy or if it was caused by an underpayment or overpayment issue.

The finished report should look similar to this (click on the image to enlarge it):

Don’t automatically rely on your student information system to properly calculate the Pell grant. Double check it, especially this first year!

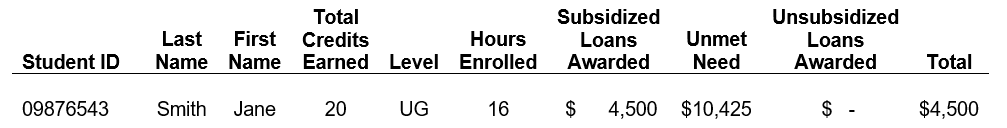

2. Create a process to identify subsidized loan awards that exceed the student’s grade level.

You could accomplish this by creating a report that helps identify students who have received a subsidized loan, along with their total credits earned. This report could be set up as follows:

In this example, Jane is a freshman but appears to have been awarded a sophomore loan amount, so she has an overawarded subsidized loan.

You should run and review this report prior to the first disbursement of the award year so that award revisions can be sent to the student before disbursement.

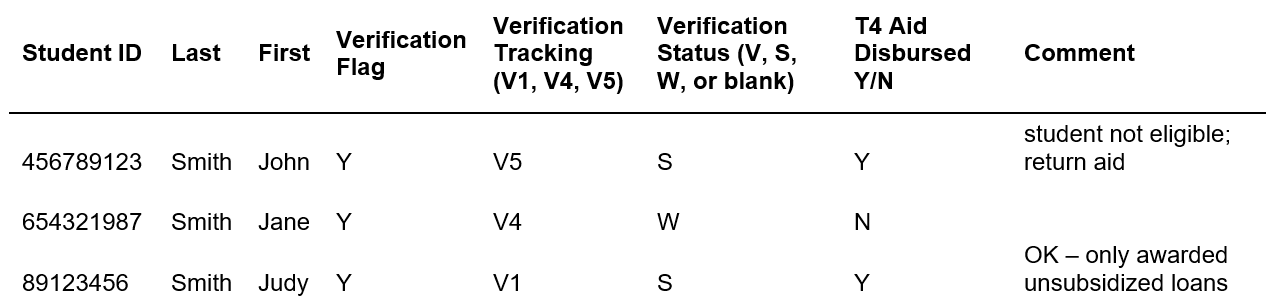

3. Run a report of all students with federal aid whose Institutional Student Information Record (ISIR) is selected for verification and indicate whether they have been verified.

The report could be set up as follows:

If a student shows up as not verified, research and document the reason why. If verification needed to be completed but was not, the aid awarded must be returned.

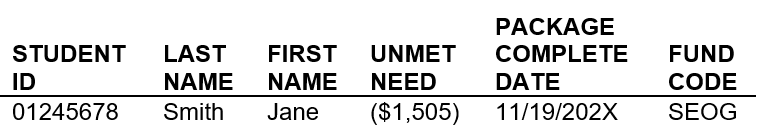

4. Develop a report to identify students who have received awards that are over-need or over-budget (cost of attendance (COA)).

This report would contain these columns:

In this example, something Jane was awarded is causing the aid to be over-need since “Unmet Need” is a negative amount. When this happens, it is important to determine the cause of the overaward. For example, if the student received subsidized loans, a Federal Supplemental Educational Opportunity Grant (SEOG), or Federal Work-Study (FWS), she has been overawarded.

This report can also include data that helps you identify students whose total awards exceed their COA. To do this, add a column that pulls the COA.

In a perfect scenario, the financial aid system would stop awards from awarding if it caused an over-budget (COA) issue. However, this issue can still occur if the budget was changed or additional scholarships were added to the package and caused the over-need, over-budget, or COA issue.

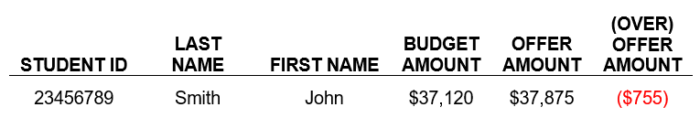

5. Look for students who had aid offered that exceeded their budget or COA.

It’s important to make sure these students’ aid was not overawarded. You could set up the report that identifies this as follows:

In the example above, the student likely experienced an event that changed his financial situation, such as moving home with his parents or receiving an outside scholarship.

Regardless of the reason, it’s important to identify this before the aid is disbursed. Review the budget to see if there was a change that would allow the higher offered amount. If not, the aid awarded must be reduced. If it was already disbursed, it must be returned. Reviewing this report before disbursing aid would prevent this from happening.

Remember that if the budget is adjusted, it may be considered a special circumstance and should be documented as such.

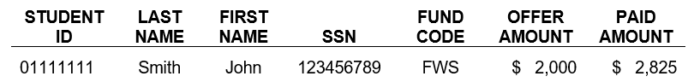

6. Monitor the level of FWS paid to see if it is greater than the level offered.

The report to identify this could be set up as follows:

In this example, the student was paid FWS wages greater than the original amount offered. Identifying this promptly will allow your institution to see if an increased FWS award is an option or if the student needs to be moved to non-work study and have his FWS wages reduced so he is not paid over need.

Reviewing this report monthly will help you promptly identify students who have exceeded their need by $300. This will allow your institution to redirect the student payroll from FWS into another institutional account so that all future earnings are recorded in the correct account. That will prevent having to make correcting journal entries at year-end, when you are busy closing out the year.

Additional Steps

Here are some other actions your institution can take to help prevent compliance findings:

- Request a list of withdrawals from the registrar a couple of times each semester. Use the list to double-check that all withdrawals have been processed properly, with any needed R2T4 calculations and subsequent returns processed within the time limits. We also recommend having a member of your financial aid department with the appropriate experience periodically review modular students’ R2T4 calculations and returns. This will help ensure that internal controls over such processes can operate effectively and achieve compliance.

- Perform a monthly reconciliation on any Pell or Federal Direct Loan (FDL) activity. Reconciliations must be done by student detail. In other words, you must compare the student’s system-disbursed amount to what the Common Origination and Disbursement (COD) detail report reflects for each student disbursement, not just the totals disbursed for each loan type.

- Maintain documentation that supports actions taken, such as satisfactory academic progress, special circumstances, reconciliations (Pell and FDL), data accumulated for the Fiscal Operations Report (FISAP), support for any correction such as an R2T4, and so on. It’s important to keep an audit trail of the compliance requirements at the point you completed them.

- Be proactive. If you encounter an error, don’t assume it is an isolated incident. Instead, look for similar issues and verify that no other students have the same overaward or compliance error.

Keep in mind that this is not an all-encompassing list but rather simple procedures your institution can use to help identify award issues before the end of the financial aid year. Taking these proactive measures can result in quick, easy wins that help you identify any issues promptly and avoid future compliance findings.

If you have any questions or would like assistance with any of the considerations above, please contact us.

This article has been updated.

Lisa R. Saul

Lisa serves as Uniform Guidance Director at CapinCrouse. She joined the firm in 1999 and has over 25 years of experience in performing and supervising Uniform Guidance audits of Department of Education student financial aid programs and a variety of federal funding, as well as program audits and agreed-upon procedure engagements of various state-funded programs. Lisa oversees the firm’s more than 90 Uniform Guidance audits.